ESTATE PLANNING

Estate planning is the process of anticipating and arranging, during a person’s life, for the disposal of their estate.

Estate planning considers everything you own— your car, home, other real estate, checking and savings accounts, investments, life insurance, furniture, personal possessions, and more. No matter how large or how modest, everyone has an estate. And, all adults should conduct estate planning to ensure it is passed on to loved ones or others, according to your wishes.

Planning for how you would like your assets to be distributed among your family or others will eliminate uncertainties over the administration of a probate. It can also help you maximize the value of the estate by reducing taxes and other expenses.

The most common documents you will need include: wills, trusts, powers of attorney, and health care directives. Other documents may also be necessary to care for you and your assets, appropriately.

Knowing you have a properly prepared plan in place – one that contains your instructions and will protect your family – will give you and your family peace of mind. This is one of the most thoughtful and considerate things you can do for yourself and for those you love – at any age or time.

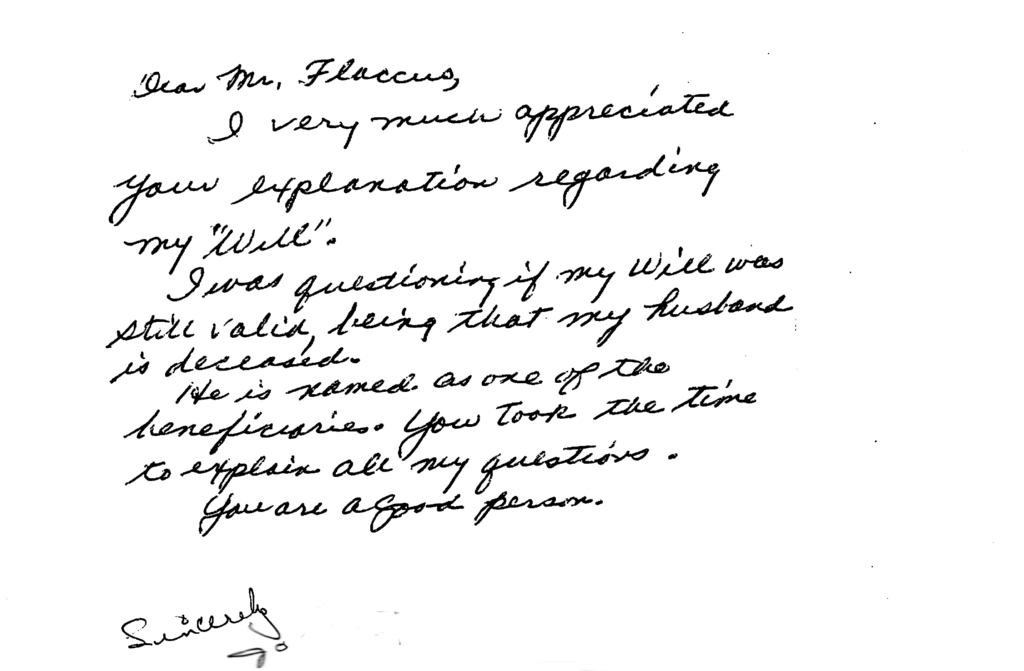

WILLS

A will provides your instructions for beneficiary designations.

A Will leaves assets to a spouse, children, charities, or other beneficiaries. We draft the wills you need and want, from simple to complex. A will appoints a “personal representative” to carry out your wishes and may include a “testamentary trust” to distribute assets to beneficiaries over a number of years.

DURABLE POWER OF ATTORNEY

A legal document that gives someone you choose the power to act in your place.

A Durable Power of Attorney appoints an attorney-in-fact as an agent to make decisions if one is incapacitated or unable to care for oneself. Powers of attorney are powerful and must be drafted carefully; we tailor durable powers of attorney to your specific needs.

HEALTH CARE DIRECTIVE

An important health related estate planning document.

A Health Care Directive informs your doctor and other health care workers whether you would want to be kept alive if you were diagnosed to be terminally ill or in a vegetative coma. A POLST is a physician’s order concerning life support treatment, and it should be harmonized with the health care directive and with other health related estate planning documents.

TRUSTS

Trusts are used for many purposes.

We draft trusts to carry out your long term or contingent wishes. For example, some families prefer to form a revocable living trust instead of a will. It can avoid probate at death, prevent court control of assets at incapacity, bring all of your assets together into one plan and provide maximum privacy. And, it can be changed by you at any time. See also our section on Trusts below for more details.

MEDICAID PLANNING

Another asset protection strategy.

Medicaid planning is sometimes needed for a people with a certain level of assets as an asset protection strategy. It is a method of organizing your assets and income so that they are inaccessible to you in order to allow you to qualify for Medicaid coverage, while preserving assets to pass on to your loved ones.

TRUSTS

Setting up a Trust in Washington State.

Trusts first developed in Medieval England. They allow you, as a “trustor,” to transfer the benefit of assets to others for a specific time and for specific purposes while a third party (the trustee) manages those assets.

We create living trusts and testamentary trusts as well as the following:

- Revocable and Irrevocable trusts

- Trusts to benefit grandchildren, or a spouse

- Tax trusts

- Charitable trusts

- Disclaimer trusts

- Special needs trusts

- Property trusts, and

- Other types of trusts.

Trusts usually have particular purposes and last for a limited period of time. For example, a trust might support a child while a minor, then switch to pay for college and graduate school. In the event of a second spouse, a trust might support one’s spouse, then support the trustor’s children upon the spouse’s death. Sometimes the beneficiaries of the trust have conflicting interests.

Washington has a unique set of laws that allow for resolution of trust disputes, known as the Trust and Estate Dispute Resolution Act, or TEDRA. In 2011, the Washington legislature passed significant changes to Washington trust law.

If you own real property in another state, you may need a “Living Trust.” Living trusts are created while a person is alive, and can avoid probate upon death.

Feel free to contact us at (206) 523.0297 with any questions you have about trusts.

REAL ESTATE TRANSFERS

Transfer real estate ownership

Property often changes hands in probate, trust, guardianship, or other family affairs. We assist in all phases of such property deeds and transfers in Washington State.

PROBATE

Probate is the process of putting a will into effect.

We represent family members and others with rights under a Will, and we represent personal representatives (also known as the “executor” or “executrix”) through the probate process. If a person dies without a Will, the process is similar except that state law dictates who receives estate assets.

Most probates are settled easily and without conflict. Occasionally probates need court intervention. Parties can often resolve differences through mediation rather than litigation. We encourage settling cases reasonably and to our clients’ advantage, however, we are ready and able to go to court for our probate clients.

LITIGATION

Litigating probate, trust, guardianship and other estate type issues.

Probate litigation generally involves legal disputes over issues related to aging, disability, and death, including court battles over those still alive.

We work with many types of estate related issues in litigation, including Probate, Trusts, Guardianships, and Protection of Vulnerable Persons, as well as legal fights over powers of attorney, medical directives, and living wills.

Although we always try to resolve conflicts out of court through mediation and settlement, there are sometimes complex circumstances that make it is necessary for a court to decide and rule.

GUARDIANSHIP

A guardianship may be required to protect adults from themselves and others.

Guardianships have been around since ancient Greece to protect adults from themselves and others. We represent family members, petitioners, proposed guardians, appointed guardians, and any party to a guardianship. Flaccus Law also represents persons who are alleged to be incapacitated in all phases of a guardianship proceeding, from initial hearings to jury trial.

In numerous cases since 1995, the Superior Court has appointed Karl as a guardian ad litem to advise the judge or jury as to the need for a guardianship – or lack of need – and the reliability and suitability of a proposed guardian, in the best interests of the alleged incapacitated person.

Guardianships can be expensive and difficult for all parties involved. Powers of attorney and trusts, when used correctly, may safeguard a person from ever needing a guardianship.